Nowadays, fintech apps are all over the place and it is perfectly fine to want to know which ones are trustworthy. Before using any fintech app, it is smart to take a moment to do some research. Understanding what you’re getting into can make all the difference.

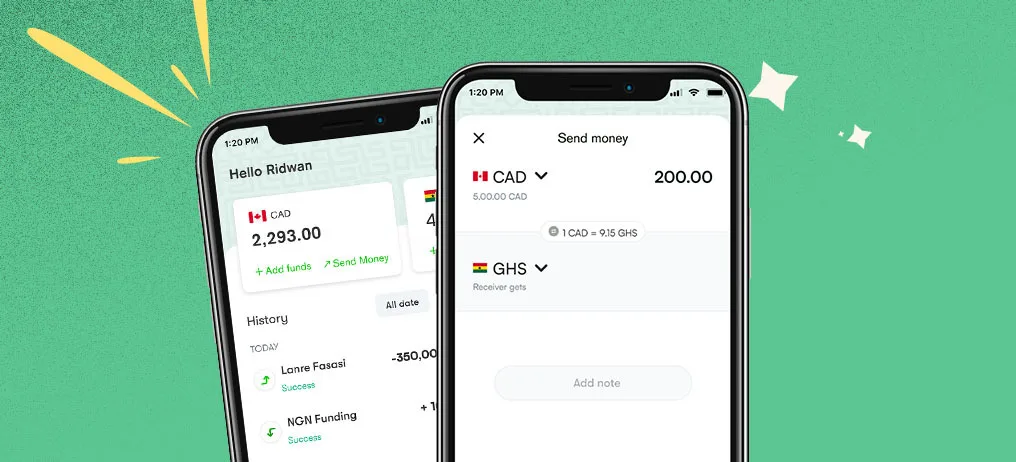

Lemonade Finance (LemFi) is headed by Rian Cochran, a former Director at Opera, and Ridwan Olalere, a former Director at OPay. As a popular fintech app, Lemonade Finance offers a global financial services platform tailored for African immigrants, providing seamless money transfer solutions from the UK, US, and Canada to several African countries, including Nigeria, Ghana, Kenya, and others.

But amidst the convenience and promises of instant transfers, a burning question arises: Is LemFi legitimate? And more importantly, can Nigerians benefit from its services?

LemFi, formerly known as Lemonade Technology Limited, operates under strict regulatory guidelines to ensure compliance and security for its users. Registered with the Financial Transactions and Report Analysis Centre of Canada as a Money Service Business (MSB), LemFi upholds credibility and accountability in its operations.

Additionally, RightCard Payment Services Limited, the trading name for LemFi, is duly registered with the Financial Conduct Authority as an Electronic Money Institution, further solidifying its legitimacy and adherence to regulatory standards.

Also Read: ZiVA: All You Need to Know About Zenith Bank Chatbot

How Much Does LemFi Charge for Transfers?

Well, the good news is Lemonade Finance doesn’t hit you with any fees for sending or receiving money through its platform. That’s pretty rare compared to other international money transfer apps out there.

But here’s the catch: depending on where you’re sending the money from, you might still get hit with an international fund transfer fee after the transfer is done.

Nevertheless, the availability of Lemonade’s services at no cost makes it a cost-effective option for Africans living abroad who need to send money back home

Can Nigerians Use LemFi?

For Nigerians looking to leverage the services offered by LemFi, the process is straightforward. By downloading the Lemonade App from the Google Play Store or the App Store and providing basic personal details such as name, address, email address, and phone number, users can quickly create their accounts.

However, before initiating transactions, account verification is necessary, ensuring compliance with regulatory requirements.

Account verification procedures vary depending on the user’s location. In the UK, verification involves submitting government-issued identity cards such as a driver’s license, British passport, or Biometric Residence Permit (BRP).

Similarly, Canadian users can verify their accounts using Canadian government-issued identity cards like a driver’s license, residence permit, Canadian passport, or provincial card.

Once the verification request is submitted, LemFi’s compliance team initiates a review process, typically completing within 24 hours, after which users receive confirmation via email.

One of the key features that make LemFi stand out is its provision of virtual Naira NUBAN accounts for Nigerian users. These accounts allow fund transfers from any bank in Nigeria; users can receive money instantly from Nigerian bank accounts.

Why are there Delays in LemFi transfers?

Many Lemonade customers have reported experiencing delays in their transfers, even after receiving a “successful” status notification. While delays are not uncommon with various money transfer apps, it’s important to understand why they occur specifically with LemFi.

Lemonade claims to process transfers instantly or within ten minutes, but the delay in reflecting the transfer in the recipient’s account can be attributed to several factors.

Firstly, Lemonade processes transfers swiftly from its end, but the timing of when the funds appear in the recipient’s bank account depends on the recipient’s financial institution and their internal processing systems. This means that even if Lemonade sends the money promptly, the recipient’s bank may take additional time to process the transfer.

Also, differences in network signals and operational procedures across jurisdictions can further contribute to delays. It’s also worth noting that recipients may not always receive immediate notification of the transfer, so it’s advisable to ask them to check their account balance.

Delays may also occur due to inactive bank accounts, invalid account numbers, or account restrictions imposed by the recipient’s financial institution.

In such cases, it is necessary to verify the recipient’s details and account status. If all checks out on the recipient’s end and the delay persists, contacting Lemonade for assistance is recommended to resolve the issue.

Summarily, LemFi is a legitimate financial services platform that addresses the needs of African immigrants, including Nigerians.