If you’ve used M-Pesa in Kenya for a while, there’s a good chance you’ve heard of Fuliza or maybe even used it. It’s a service that lets you complete M-Pesa transactions even when you don’t have enough money in your account. While that sounds convenient, it can become frustrating when you find yourself constantly owing Safaricom and getting deductions any time you receive money.

Many people sign up for Fuliza without fully understanding how it works. Some don’t even remember opting in, while others were pushed into it by financial emergencies. But now, you’re ready to stop using it. You’re tired of unexpected deductions. You want full control of your M-Pesa balance again. Opting out is possible.

This guide breaks down everything you need to know about how to opt out of Fuliza on your Safaricom line. It’s simple, quick, and can save you a lot of stress going forward.

What Is Fuliza and How Does It Work?

Fuliza is an overdraft service offered by Safaricom in partnership with NCBA Bank. It allows M-Pesa users to complete transactions even when they have insufficient funds. You can send money, pay bills, or buy airtime using Fuliza, and the balance is deducted the next time you receive money in your M-Pesa wallet.

Fuliza works automatically once you’ve opted in. If you try to send money and don’t have enough, Safaricom will cover the difference using Fuliza and show you how much you’re borrowing. The catch is this: you’re charged daily fees on the amount borrowed until you repay it. This means if you stay negative for several days, your total repayment will keep growing.

Many users find this stressful, especially when they receive money and a good chunk of it disappears to repay Fuliza. That’s why some people decide it’s time to step away from the service.

Why Do People Want to Opt Out of Fuliza?

Here are some of the most common reasons people decide to cancel Fuliza:

- Constant Deductions: Every time someone sends you money, Fuliza deducts what you owe automatically, leaving you with less than you expected.

- Overreliance on Credit: Fuliza can lead to a cycle of borrowing, especially if you use it regularly without keeping track.

- Financial Discipline: Some users want to manage their money more consciously without depending on overdrafts.

- No Longer Needed: You may have signed up during an emergency but now feel it’s unnecessary.

How to Check If You’re Currently Using Fuliza

Before you cancel Fuliza, it helps to confirm whether your line is currently subscribed and if you have an outstanding balance.

Steps to check:

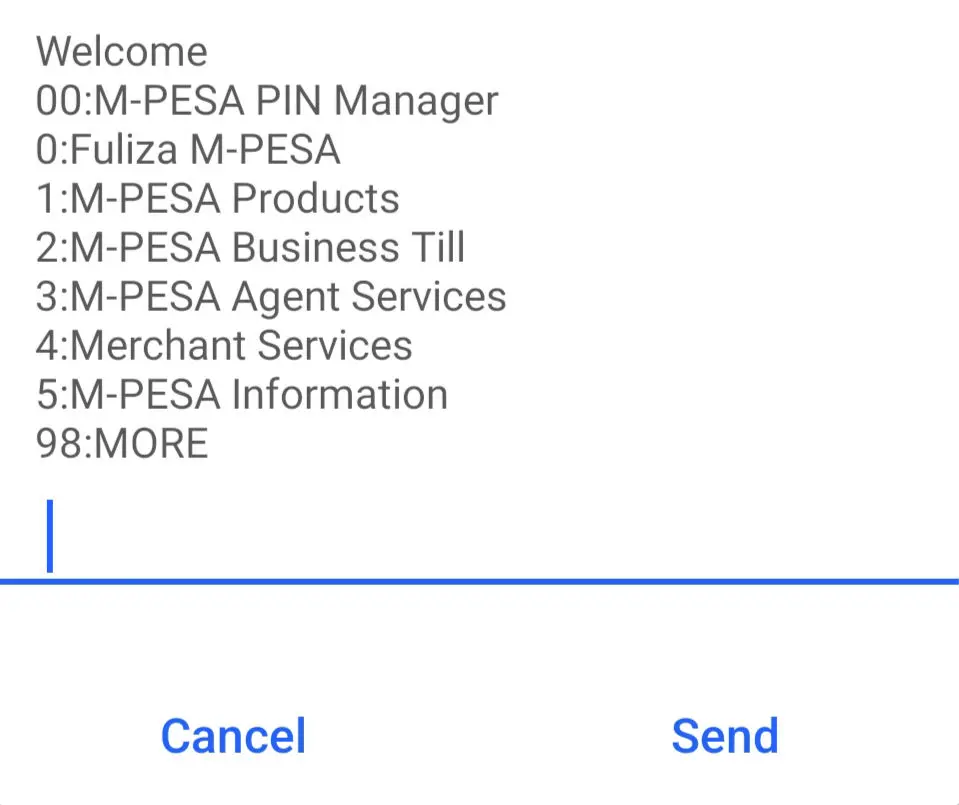

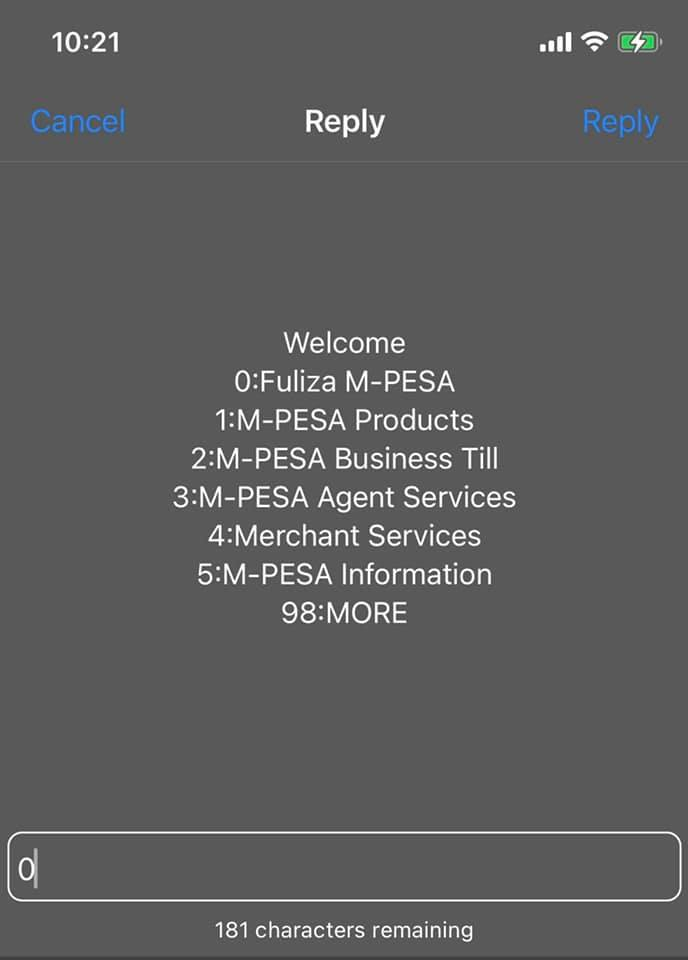

- Dial *234# on your Safaricom line

- Select option 0: Fuliza M-PESA

- Choose Check Balance

If you have an outstanding Fuliza loan, the system will show how much you owe. You will need to clear this balance before opting out completely.

How to Repay Your Fuliza Balance Before Opting Out

Safaricom doesn’t allow users to cancel Fuliza while they have an outstanding balance. So the first step is to make sure your Fuliza loan is fully cleared.

To repay:

- Simply deposit money into your M-Pesa account.

- Safaricom will automatically deduct the amount you owe from your Fuliza.

- If you owe more than you have, it will deduct partially until you clear the balance.

Once your balance reads zero, you’re now free to cancel the service.

Also Read: How to Speak to a Safaricom Agent and Get Your Issue Resolved

How to Opt Out of Fuliza Completely

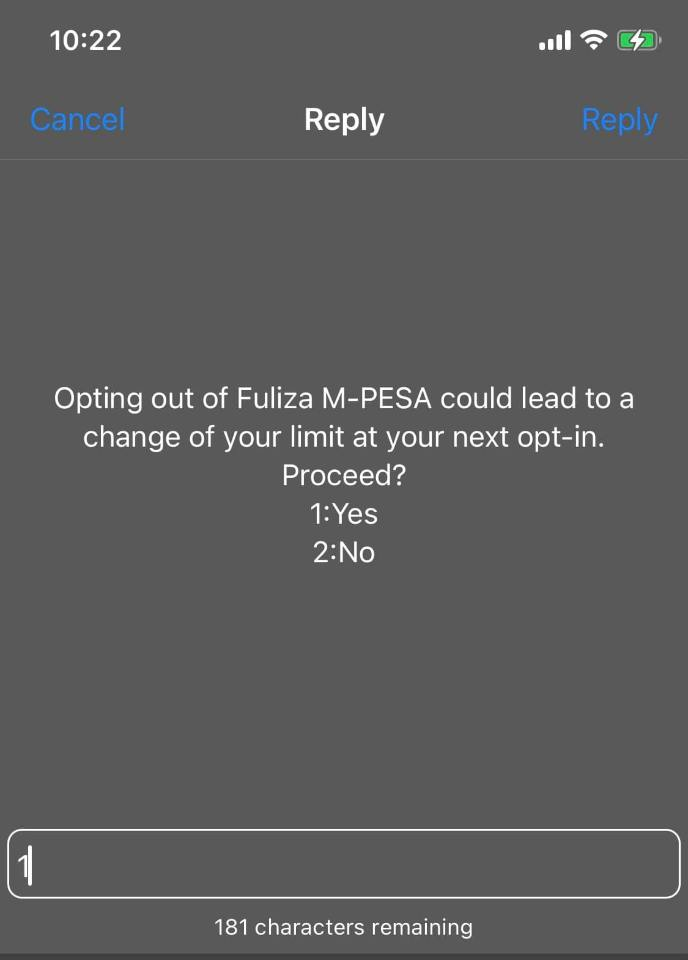

Once you’ve cleared your outstanding Fuliza balance, you can follow these steps to cancel the service:

Step-by-step process:

- Dial *234#

- Choose 0: Fuliza M-PESA

- Select 7: Opt Out

The system will confirm that you’ve successfully opted out. Once done, you will no longer be able to use Fuliza and no more deductions will be made from your M-Pesa account.

You’ll still be able to use all the regular M-Pesa services. But now, if you try to send money without enough balance, the transaction will simply fail instead of borrowing from Fuliza.

Can You Rejoin Fuliza After Opting Out?

Yes. Opting out is not permanent. If you change your mind or need the service again in future, you can opt back in using the same process.

To rejoin:

- Dial *234#

- Select 0: Fuliza M-PESA

- Choose Opt In

Make sure you meet Safaricom’s eligibility criteria at the time. Your Fuliza limit might change depending on your usage and past repayment behaviour.

Does Opting Out of Fuliza Affect Your M-Pesa or Credit Score?

Opting out of Fuliza does not affect your ability to use M-Pesa. You can still send and receive money, pay bills, buy airtime and more.

As for your credit score, Fuliza reports to the Credit Reference Bureau (CRB) only if your account is seriously overdue. If you’re not defaulting for weeks or months, you’re unlikely to face any consequences. Just make sure to clear any balance before opting out.

What If You Don’t Remember Opting Into Fuliza?

This happens often. You might have opted in accidentally while navigating M-Pesa menus or maybe during a quick transaction when you were low on funds. Fuliza is designed to activate instantly once you accept its terms.

If you don’t remember opting in, follow the steps shared above to confirm your status and check if you have a balance. If you do, clear it and opt out.

Can You Disable Fuliza Without Paying What You Owe?

No, Safaricom requires full repayment before you can cancel Fuliza. There is no workaround. If you’re struggling to repay, consider breaking it down into smaller amounts. Even partial deposits reduce the balance.

You won’t be able to avoid payment by switching off the service. The system will keep deducting from any money that comes into your account until it’s cleared.

What Are the Daily Charges for Using Fuliza?

Here’s a simplified breakdown of Fuliza’s daily fees:

- For borrowing up to KSh 100: No daily charge, only a one-time fee of KSh 2

- KSh 101 – 500: KSh 5 daily

- KSh 501 – 1000: KSh 10 daily

- KSh 1001 – 1500: KSh 20 daily

- KSh 1501 – 2500: KSh 25 daily

- KSh 2501 – 70000: KSh 30 daily

This means the longer you take to repay, the more it costs. Many people don’t realise how quickly these small fees add up. That’s one major reason why cancelling the service can be a smart financial decision.

How to Avoid Reactivating Fuliza

Once you opt out, it’s easy to stay off if you apply a few smart habits:

- Always check your balance before transacting

- Avoid relying on overdrafts for daily expenses

- Budget your airtime and M-Pesa usage weekly

- Use savings or emergency funds instead of Fuliza

These habits help you take back control and avoid the pressure that comes with unexpected deductions or rolling debt.

Getting out of Fuliza doesn’t mean you’re against borrowing. It just means you want better control of your money. Many people in Kenya feel trapped in the cycle of sending and receiving money while constantly watching it disappear due to Fuliza. That alone can be frustrating and financially draining.

Opting out gives you the space to reset. You get your full M-Pesa balance without automatic deductions. And if you ever want to come back to Fuliza, it’s just a few clicks away. But now you’re doing it on your terms.