A business loan can sometimes be the extra push a company needs to move forward. Maybe you want to expand your shop, pay for essential running costs, or grab a big opportunity that is right in front of you. Access to the right funding can turn ideas into action, giving you the financial strength to grow, take bold steps, and build the kind of business you have in mind. In Nigeria, different banks now provide loan options that fit small, medium, and large businesses. Let’s look at some of the leading banks that offer these loans, what each of them provides, and how you can boost your chances of getting approved.

1. Access Bank

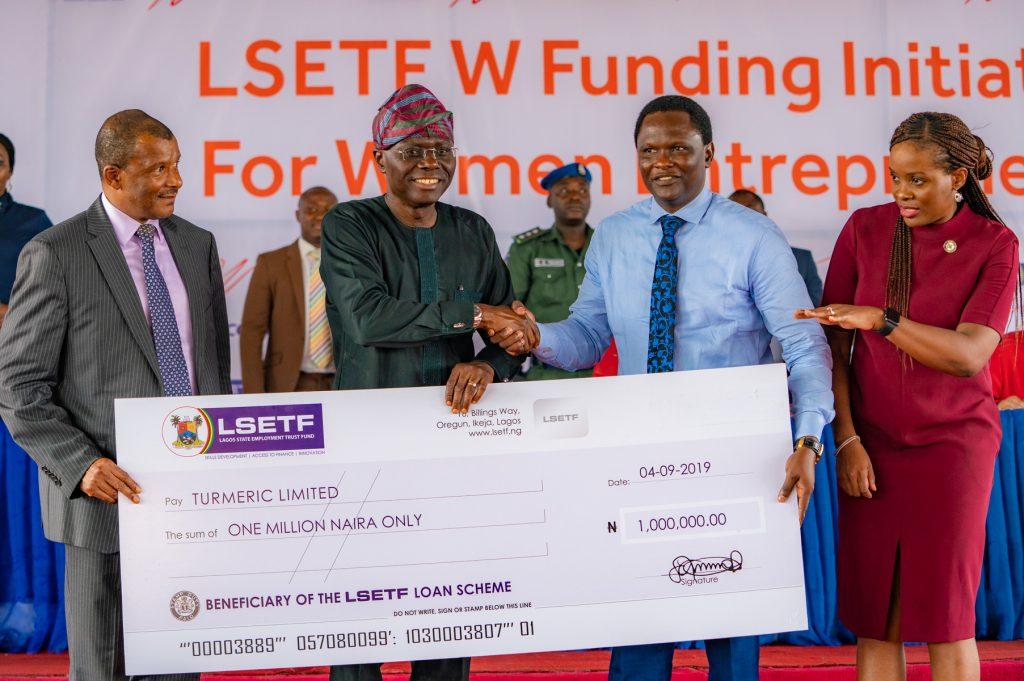

Access Bank is known for its focus on supporting small and medium-sized enterprises (SMEs) through a range of loan products. One popular option is the SME Loans, which includes financing solutions like the LSETF (Lagos State Employment Trust Fund) loan, providing affordable loans to entrepreneurs based in Lagos.

- Types of Loans Offered: Access Bank provides overdrafts, invoice discounting, term loans, and more. Some loan products are geared towards asset acquisition, while others support daily business needs.

- Application Process: Access Bank’s application process typically involves presenting a business plan, financial records, and proof of revenue streams. The bank also encourages digital applications via its online platform.

2. First Bank of Nigeria (FBN)

First Bank is another reliable option for Nigerian business owners. With a reputation for stability, FBN offers FirstEdu Loan, targeted toward school owners needing funds for expansion or infrastructure, and FirstTrader Solutions, which provides quick credit for registered market traders.

- Types of Loans Offered: Apart from sector-specific loans, FBN offers overdrafts, commercial mortgages, and working capital loans.

- Specialized Support: First Bank also provides advisory services for businesses applying for loans, ensuring entrepreneurs are well-prepared.

3. Zenith Bank

Zenith Bank offers a variety of loans for small and large businesses alike. The Zenith Bank SME Loan focuses on businesses needing capital for growth or expansion and provides flexible repayment terms.

- Types of Loans Offered: Business loans include working capital finance, term loans, and import finance.

- Special Features: Zenith’s SME Growth Support helps qualifying businesses access loans with relatively lower interest rates, ideal for emerging companies. They also offer digital platforms to streamline the application and loan management process.

4. GTBank (Guaranty Trust Bank)

GTBank’s loan options are known for their accessibility. For instance, their SME Loans cater to different sectors, including healthcare, agriculture, and retail, allowing businesses in these areas to access essential funds quickly.

- Types of Loans Offered: GTBank offers overdrafts, term loans, and invoice discounting, along with the “Quick Credit for SMEs” facility.

- Quick Credit for SMEs: This specific product is unique in that it offers pre-approved loans at lower interest rates, making it ideal for smaller businesses needing fast financing. The application process is straightforward and available on the GTBank app, adding convenience for digital-savvy entrepreneurs.

5. Union Bank of Nigeria

Union Bank has made notable strides in supporting SMEs through its SME Business Loans and Loan Products for Women-Led Businesses. Union Bank’s loans cater to those in agriculture, education, and other sectors, with options specifically created for women entrepreneurs.

- Types of Loans Offered: Union Bank provides working capital loans, term loans, and asset finance options.

- Women-Centric Products: Union Bank’s women-focused loans offer reduced interest rates and easier access, supporting female business owners with initiatives that promote financial inclusion.

6. Fidelity Bank

Fidelity Bank offers a variety of loan products for SMEs, with a commitment to digital tools that streamline loan applications. The Fidelity SME Loans provide options that target working capital, fixed asset acquisition, and even trade financing.

- Types of Loans Offered: Fidelity Bank offers overdrafts, invoice discounting, and import finance loans.

- Digital Process: Fidelity’s loan application is heavily digitized, which appeals to modern entrepreneurs who value convenience and efficiency.

7. Stanbic IBTC Bank

Stanbic IBTC offers tailored financial products through its Enterprise Banking division. Their SME loans include the Enterprise Loan and Agriculture Loan, aimed at agribusinesses that need financing for expansion.

- Types of Loans Offered: The bank offers a variety of working capital loans, asset financing, and contract financing for businesses.

- Agriculture Focus: Stanbic IBTC’s Agriculture Loan provides flexible terms, particularly for agribusinesses that have seasonal income, helping them manage repayment according to their income cycles.

8. Development Bank of Nigeria (DBN)

While not a commercial bank, the Development Bank of Nigeria (DBN) is noteworthy because it partners with other Nigerian banks to provide SMEs with low-interest loans. DBN loans are typically channeled through partner banks, so business owners can apply for DBN funding through Access Bank, Ecobank, or Fidelity Bank, among others.

- Special Focus on SMEs: DBN loans are aimed at micro, small, and medium enterprises (MSMEs) and often come with lower interest rates and flexible repayment terms.

- Partner Banks: DBN doesn’t lend directly to businesses; instead, it works with partner banks. This approach ensures that businesses can apply for DBN funding through their preferred banks with minimal paperwork.

What You Should Know Before Applying for a Business Loan in Nigeria

Applying for a business loan requires preparation. Here are some practical steps to improve your chances of approval:

- Prepare a Clear Business Plan: Most banks want to see a detailed business plan that explains your business model, market strategy, and financial forecasts.

- Maintain Good Financial Records: Banks will review your financial history, so maintaining accurate, up-to-date records is important. Positive cash flow and consistent revenue streams can help increase your credibility.

- Build a Solid Credit History: Having a good credit history will improve your chances of getting approved, as it demonstrates your ability to manage and repay debt.

- Research Each Bank’s Requirements: Different banks have different criteria for approval. Researching each bank’s specific requirements can save you time and increase your chances of success.

- Consider Collateral: Some banks may require collateral, so be prepared to pledge assets if necessary.

Securing a business loan in Nigeria is now easier than ever, thanks to a variety of options from leading banks. For startups, expanding businesses, or specialized ventures, these banks offer various loan products designed to meet different business needs. With a bit of preparation and the right partnership, you can get the financial support you need to make your business grow.