Ever thought about how life in Ghana is getting easier by the day? Well, let me tell you – it’s all thanks to the amazing world of fintech! From bustling cities to quiet villages, fintech platforms in Ghana are changing the game when it comes to managing money.

Picture this: you can pay bills, send money to friends, and even invest, all from the comfort of your phone. It’s like having a personal financial assistant right in your pocket, ready to help with your every financial need. Let’s take a look at the top five fintech platforms in Ghana.

Table of Contents

Zeepay

Zeepay, a rising star among fintech platforms in Ghana, is making waves with its focus on mobile money and international remittance services. It stands out as the first fintech company in Ghana to secure a Dedicated Electronic Money Issuer license from the Bank of Ghana, the country’s top financial regulatory institution. Zeepay’s impact is palpable, facilitating seamless cross-network money transfers.

One of Zeepay’s remarkable achievements is its ascent to become the second-largest fintech app in terms of Mobile Financial Services (MFS) revenue in Ghana. This feat was accomplished by surpassing Vodafone Cash, a significant player in the market.

Zeepay’s growth is propelled by its innovative approach to connecting different digital assets, like mobile wallets and bank accounts, with international money transfer services.

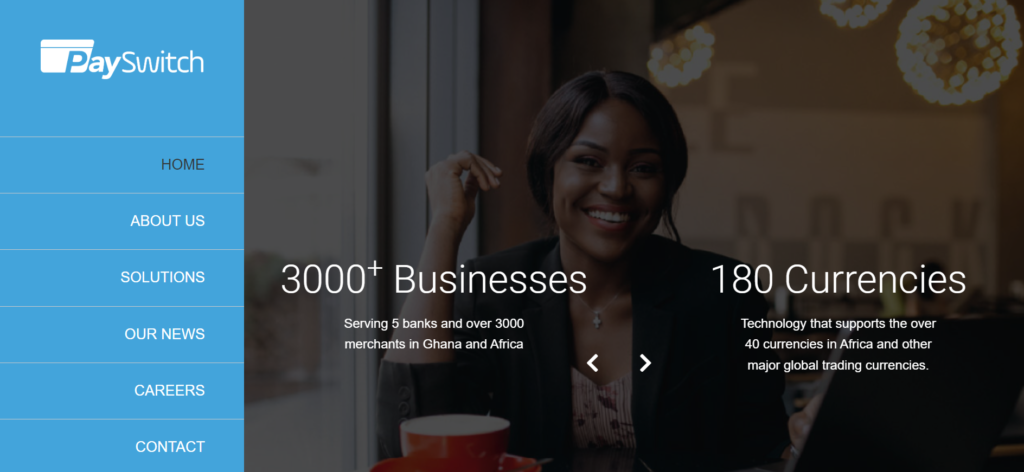

PaySwitch

Imagine a platform that facilitates the exchange of money and values between individuals, organisations, and businesses with just a few clicks. PaySwitch does just that, offering integrated payment solutions for a wide range of transactions, from person-to-person transfers to business-to-business transactions.

Their target market spans commercial banks, non-banking financial institutions, telecommunication companies, and other players in the payment space across Ghana and West Africa.

But PaySwitch doesn’t stop there – they also serve as a powerful payment enabler for startups and large organisations alike.

Through their incubator Payments program, startups can access their flexible systems and a variety of payment options with ease, without the stress of dealing with multiple service providers or committing to upfront fees.

MTN Mobile Money (MoMo)

MTN MoMo, short for MTN Mobile Money, is one of the most popular fintech platforms in Ghana, and for good reason. With its convenient USSD and mobile application services, MTN MoMo has become the go-to choice for millions of users across the country.

What sets MTN MoMo apart is its impressive track record – processing over 900 million transactions monthly across sixteen African countries, serving a staggering 50 million users.

That’s right, whether you’re sending money to family, paying bills, or topping up airtime, MTN MoMo makes it easy to get things done, all from the palm of your hand. With its widespread adoption and smooth user experience, MTN MoMo continues to redefine the landscape of fintech in Ghana, offering unparalleled convenience to its ever-growing user base.

ExpressPay

ExpressPay offers instant money transfers and bill payments for Ghanaians. With just a few taps, you can send money instantly to Airtel Money, MTN Mobile Money, Tigo Cash, Vodafone Cash, or even directly to a bank account. No more long queues or tedious processes – expressPay makes it quick and easy to handle all your financial transactions from the comfort of your home or office.

But that’s not all – ExpressPay goes above and beyond by allowing consumers to send money to over twenty banks from its single platform. With its commitment to efficiency, reliability, and user-friendly experience, ExpressPay is reshaping the fintech landscape in Ghana, making financial transactions more accessible and convenient for everyone.

Hubtel

Hubtel is a game-changer amongst fintech platforms in Ghana. Imagine having all your favorite stores right at your fingertips, with reliable service guaranteed. That’s exactly what Hubtel offers – a convenient shopping and delivery experience. From electronics to baby products, fashion accessories to health and fitness items, Hubtel has it all covered.

But Hubtel isn’t just about shopping, it is also a go-to fintech platform in Ghana. Need to pay your TV bills or top up your internet data? Hubtel has you covered. Want to try your luck with sports betting or send money to the bank? Hubtel makes it easy. Plus, with their mobile money services, transferring funds is as simple as a few taps on your phone.

Additionally, Hubtel’s innovative POS platform allows businesses to accept mobile money, cards, and QR codes, digitizing their payment processes and propelling them into the digital age.

Ghana’s fintech landscape is flourishing with innovation and growth, driven by various platforms that address diverse financial needs. From mobile money solutions to payment processing services, these top five fintech platforms are dramatically changing how Ghanaians manage their finances. With Ghana wholeheartedly embracing the digital age, these fintech platforms are poised to radically reshape the future of finance within the country.