If you’re a fan of Burna Boy, you’ve probably noticed that the Grammy-winning artist is the global brand ambassador for Chipper Cash. With a celebrity of his caliber representing the fintech app, there’s a good chance you’ve come across Chipper Cash, heard about it from friends, or even considered using it yourself. But beyond the star power and promotions, one pressing question remains: Is Chipper Cash safe for cross-border payments? Let’s break it down and see why millions trust this app.

Is Chipper Cash Approved by CBN?

When it comes to financial transactions in Nigeria, one of the first questions users often ask is whether a platform is approved by the Central Bank of Nigeria (CBN). This is a valid concern, as the CBN is the regulatory body overseeing financial activities in the country, making sure that platforms operate within the bounds of the law and protect users’ funds.

As of now, Chipper Cash operates in compliance with the financial regulations of the countries it serves. However, in Nigeria, Chipper Cash doesn’t function as a bank; it works more as a payment service provider. This means it’s not a deposit-taking institution but rather a platform that facilitates transactions.

Chipper Cash’s compliance with local regulations helps reassure users that their transactions are handled securely. That said, you should always double-check the app’s terms and conditions and keep an eye on any updates from regulatory authorities like the CBN.

Can I Receive Dollars in My Chipper Account?

Another common question among users is if Chipper Cash supports receiving dollars. After all, being able to handle multiple currencies is one of the benefits of any cross-border payment platform.

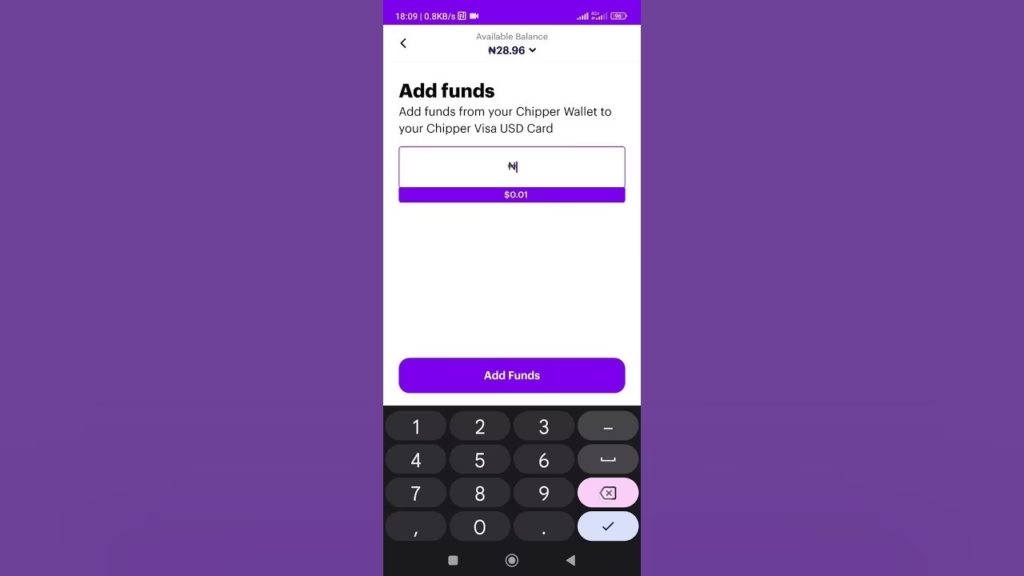

The good news is that the platform does allow users to receive dollars. In fact, the app supports transactions in multiple currencies, including USD, GBP, and more. This feature is particularly beneficial for freelancers, remote workers, and businesses that deal with international clients.

When someone sends you money in dollars, the funds will appear in your Chipper Cash wallet, and you can either withdraw it directly to your bank account or use it within the app. Keep in mind, though, that currency conversion rates may apply if you decide to switch between currencies within the app. While the rates are generally reasonable, it’s always a good idea to compare them with other platforms to make sure you’re getting the best deal.

How Long Does Chipper Cash Verification Take?

Account verification is an important step when signing up for any financial platform. It ensures that the platform complies with anti-money laundering (AML) regulations and protects both the users and the company from fraudulent activities. So, how long does it take to get verified on Chipper Cash?

The verification process on Chipper Cash is relatively straightforward. When you sign up, you’ll be required to provide basic personal information such as your name, email address, and phone number. To unlock higher transaction limits and access additional features, you’ll need to complete a more in-depth verification process, which includes submitting a valid government-issued ID and sometimes a photo for identity confirmation.

On average, verification on Chipper Cash takes anywhere from a few hours to 48 hours. However, in some cases, it might take longer, especially if there are discrepancies in the information you’ve provided or if there’s a high volume of verification requests at the time.

To speed up the process, make sure you’re providing accurate and clear documentation. Double-check your details before submitting them and make sure your ID is not expired. If you experience delays, Chipper Cash’s customer support team is usually responsive and can assist you with any issues.

How Much Is 1 Dollar on Chipper Cash?

Exchange rates are a major consideration when using any payment platform. Users often want to know how much 1 dollar is worth on Chipper Cash compared to other platforms or the parallel market.

Chipper Cash uses real-time exchange rates for currency conversions. While the exact rate for 1 dollar on Chipper Cash can fluctuate depending on market fluctuations, the platform is generally transparent about its rates. You can easily check the rate within the app before completing a transaction.

It’s worth noting that while Chipper Cash’s rates are reasonable, they may not always match the black-market rate. If getting the best possible rate is your top priority, you might want to compare Chipper Cash with other services.

Is Chipper Cash Safe to Use?

The primary factor determining the safety of a payment platform lies in its ability to safeguard user funds and personal information. With this in mind, is Chipper Cash a secure option for cross-border transactions?

Chipper Cash employs encryption technology to safeguard users’ data and transactions. The app also complies with global AML and Know Your Customer (KYC) standards, which are designed to prevent fraud and financial crimes. Additionally, the platform’s user-friendly interface and transparent terms make it easy for users to understand and handle their transactions.

Like any financial app, it’s important to take your own precautions to improve security. Use a strong, unique password for your Chipper Cash account, enable two-factor authentication (2FA), and avoid sharing your login details with anyone. If you notice any suspicious activity, report it to Chipper Cash’s customer support immediately.

Summarily, Chipper Cash is a safe and reliable option for cross-border payments. Before you decide, take a look at what Chipper Cash offers and see if it’s a good match for you. It offers convenience, reasonable fees, and support for multiple currencies. If you’re sending money to family, receiving international payments, or simply looking for a new way to manage your finances, the platform provides a seamless experience.