Flutterwave is a popular payment platform in Africa that helps businesses easily receive payments from customers, both locally and internationally. This guide will show you how to open a Flutterwave account, answer your questions about the process, and give you some tips on how to use Flutterwave effectively.

Flutterwave is more than just a payment platform; it’s a solution designed to meet the challenges of African businesses. With support for multiple currencies, international payment options, and integrations with popular tools, it’s a go-to solution for scaling businesses. Here are some of its features:

- Ease of Use: A user-friendly interface that simplifies payment processes.

- Global Reach: Accept payments from customers in over 150 currencies.

- Security: High-level encryption to protect transactions.

- Flexibility: Suitable for businesses of all sizes, from startups to corporations.

- Integration: Compatible with platforms like Shopify, WordPress, and mobile apps.

Now that you know why Flutterwave is a great choice, let’s get started on creating your account.

How Do I Open a Flutterwave Business Account?

Opening a Flutterwave business account is a straightforward process that requires a few essential details. Follow these steps to get started:

1. Visit the Flutterwave Website

To create an account, go to the official Flutterwave website at www.flutterwave.com. Make sure you’re on the legitimate site to avoid phishing scams.

2. Click on “Create Account”

On the homepage, click the “Create Account” button. You’ll be redirected to the sign-up page.

3. Choose an Account Type

Flutterwave offers two main account types:

- Personal: Suitable for freelancers or individuals looking to accept payments for personal services.

- Business: Designed for businesses that need advanced features such as payment links, POS, and APIs.

For this guide, we’ll focus on creating a business account.

4. Fill in Your Details

Provide the following information:

- Name: Your full name or business name.

- Email Address: A valid email you have access to.

- Phone Number: A working phone number for verification.

- Password: Create a strong password.

Click “Sign Up” once you’ve filled in the details.

5. Verify Your Email Address

After signing up, Flutterwave will send a verification link to your email. Check your inbox and click on the link to verify your email address.

6. Complete Your Profile

Log in to your account and navigate to the dashboard. You’ll be prompted to complete your profile. Here’s what you’ll need:

- Business Information: Provide your business name, type, and description.

- Address: Enter your business address.

- Industry: Select the category that best fits your business.

- Tax Identification Number (TIN): This is optional but recommended for compliance.

7. Upload Required Documents

For verification, you’ll need to upload:

- Government-issued ID: Such as a passport, driver’s license, or national ID.

- Business Registration Documents: CAC certificate (for Nigerian businesses) or equivalent documentation in your country.

- Bank Statement: This helps verify your business’s financial legitimacy.

8. Add Your Bank Details

To receive payouts, you’ll need to link a bank account. Enter your bank name, account number, and account name. Make sure the details are accurate to avoid delays in payments.

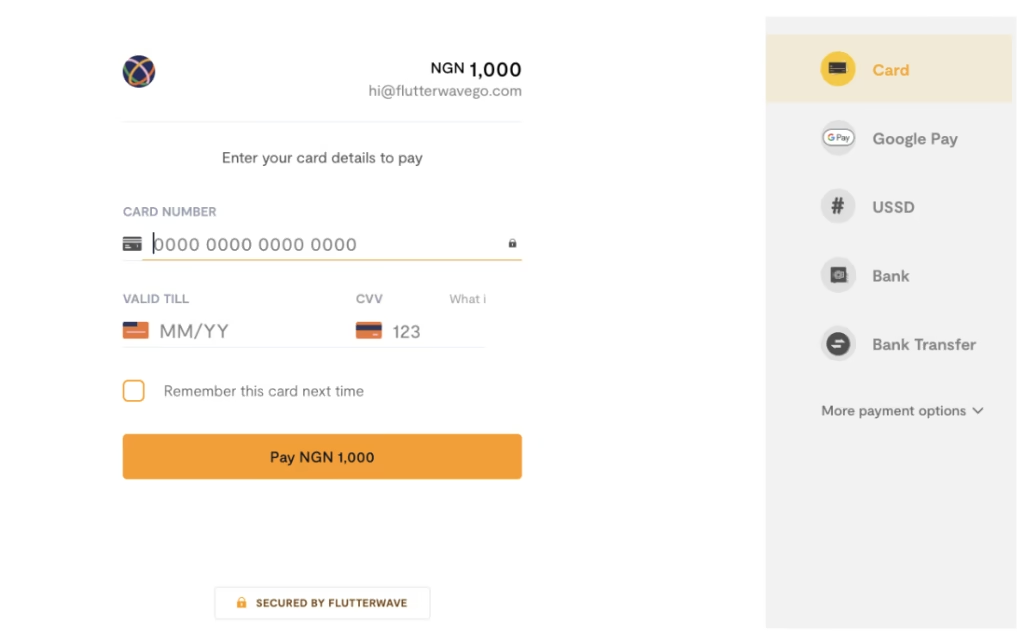

9. Set Up Payment Options

Flutterwave allows you to accept payments via multiple channels, including:

- Cards (Visa, Mastercard, Verve)

- Mobile Money

- Bank Transfers

- USSD

You can customize these options in your dashboard based on your business needs.

10. Test Your Account

Before going live, it’s a good idea to test your account using Flutterwave’s sandbox environment. This helps you understand how transactions will work without using real money.

Once your account is verified and set up, you’re ready to start accepting payments!

Is Flutterwave Approved by CBN?

One common question among Nigerian business owners is whether Flutterwave is approved by the Central Bank of Nigeria (CBN). The answer is yes. Flutterwave is a fully licensed payment service provider in Nigeria and adheres to the regulations set forth by the CBN.

Here’s what you should know:

- Licensing: Flutterwave holds a Payment Solutions Service Provider (PSSP) license issued by the CBN.

- Compliance: The platform complies with CBN’s Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

- Security Standards: Flutterwave uses advanced security measures, including PCI-DSS compliance, to protect transactions.

This approval means that Flutterwave operates within legal frameworks, giving users confidence in its reliability.

How to Get the Most Out of Your Flutterwave Account

To make the most of your Flutterwave account, consider these tips:

1. Customize Your Checkout Page

Flutterwave allows you to customize your checkout page to match your brand’s aesthetics. Add your logo, change the colors, and create a seamless customer experience.

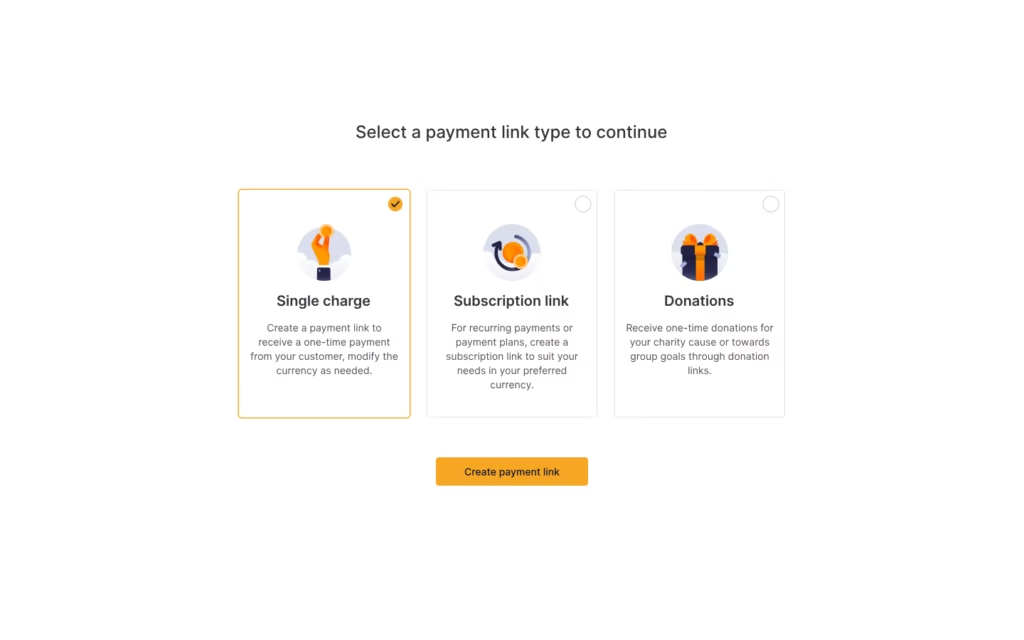

2. Use Payment Links

If you don’t have a website, you can use Flutterwave’s payment links to accept payments. Simply create a link, share it with your customers, and get paid instantly.

3. Integrate with Your Website or App

If you have an online store, integrate Flutterwave’s payment gateway for a smooth checkout process. Popular platforms like Shopify, WooCommerce, and Wix are supported.

4. Enable International Payments

Expand your reach by enabling international payments. This feature allows you to accept payments from customers worldwide in their local currencies.

5. Monitor Transactions

Keep track of all transactions through the dashboard. Flutterwave provides detailed analytics, helping you make data-driven decisions to grow your business.

Opening a Flutterwave account is a simple yet powerful move for any business, big or small. It’s like having a reliable partner to handle all your payments, whether you’re selling locally or reaching customers across the globe. Plus, knowing that Flutterwave is approved by the CBN gives you that extra peace of mind. So, don’t let outdated payment methods hold you back.