Starting an online store in Nigeria comes with a lot of decisions, but one of the most important is how you’ll accept payments. A smooth and secure payment system can make or break your e-commerce business. If you’ve chosen WooCommerce to run your store, you’re already on a solid platform. But the next big step is figuring out how to collect payments from customers in a way that’s easy, fast, and trusted locally.

Flutterwave stands out as one of the most popular payment gateways in Africa. It works seamlessly with Nigerian banks and allows you to receive payments in Naira, dollars, and other currencies. In this guide, we’ll walk you through why integrating Flutterwave with WooCommerce is a great option and how you can set it up without stress. If you’re an entrepreneur, small business owner, or tech-savvy seller, this is for you.

Jump to Section

What Is WooCommerce and Why Is It Popular in Nigeria?

WooCommerce is a free plugin that turns any WordPress site into an e-commerce store. It gives you the freedom to sell anything, from physical goods to digital downloads, subscriptions, or services.

In Nigeria, WooCommerce is loved because it’s cost-effective and customizable. You don’t need to pay huge monthly fees like with some other platforms, and you can control every part of your store. From product listings to shipping options and promotions, WooCommerce gives you complete control.

But to collect payments, especially in Naira, you need a payment gateway that understands the local market. That’s where Flutterwave comes in.

Why Choose Flutterwave for Your WooCommerce Store?

If you’re selling online in Nigeria, the payment method you offer is a big deal. Customers want something they already know and trust. Flutterwave is built for African businesses and works directly with Nigerian banks.

Here’s why it’s a top choice:

- Supports Local and International Payments: Accepts Naira, USD, GBP, and more.

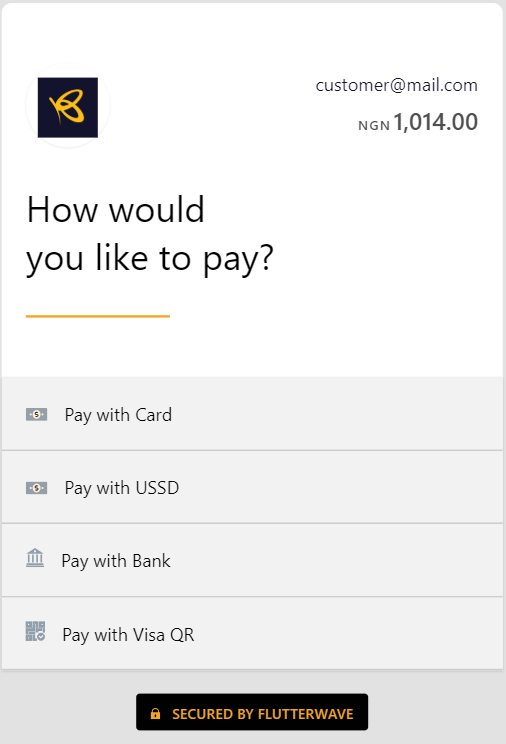

- Multiple Payment Options: Cards, bank transfers, USSD, and mobile money.

- Fast Settlement: Funds are settled quickly into your local bank account.

- User-Friendly Dashboard: Track transactions, view analytics, and manage payouts.

- Trusted by Major Brands: Used by top businesses like Uber, PiggyVest, and MTN.

Most importantly, it’s easy to integrate with WooCommerce.

How Do I Integrate Flutterwave with WooCommerce?

You don’t need to be a developer or tech expert. The process is beginner-friendly and can be done in under 30 minutes.

Step 1: Install WordPress and WooCommerce

If you haven’t already, set up a WordPress website and install the WooCommerce plugin. It’s free and available in the WordPress plugin directory. Follow the WooCommerce setup wizard to add your store details, currency (Naira), shipping, and products.

Step 2: Create a Flutterwave Business Account

Go to https://www.flutterwave.com and sign up for a business account. You’ll need to verify your email, business name, and bank details.

Once your account is approved, log in and go to Settings > API. Here, you’ll find your Public Key, Secret Key, and Encryption Key. Keep these safe because you’ll use them to link your store.

Step 3: Install the Rave (Flutterwave) WooCommerce Plugin

In your WordPress dashboard:

- Go to Plugins > Add New

- Search for Flutterwave WooCommerce or Rave Payment Gateway for WooCommerce

- Click Install Now then Activate

Now your store is ready to be connected.

Step 4: Configure the Plugin

After activation:

- Go to WooCommerce > Settings > Payments

- Click on Flutterwave (Rave)

- Enable the payment method

- Enter your Public Key, Secret Key, and Encryption Key

- Set your store currency to NGN

- Customize the payment instructions (optional)

Save your changes.

That’s it! Your store can now accept payments using Flutterwave.

Can I Accept Bank Transfers, USSD, or Card Payments?

Yes. Flutterwave supports multiple payment channels that are common in Nigeria:

- Bank Transfers: Customers can pay directly from their bank account using a unique code.

- USSD Payments: Popular with mobile users who don’t have internet access or prefer offline payments.

- Card Payments: Both local and international debit/credit cards are supported.

You don’t need to activate each channel manually. Once you enable Flutterwave, your store automatically gives customers all the available options based on their location and device.

Is It Safe to Use Flutterwave with WooCommerce?

Absolutely. Security is one of Flutterwave’s strongest points. Here are some safety features:

- PCI-DSS Compliance: Flutterwave meets international standards for handling card data.

- Tokenization: Card details are encrypted and never stored on your site.

- 3D Secure Checkout: Adds extra verification for card payments.

- Fraud Monitoring: Every transaction is analyzed for suspicious behavior.

As a store owner, you also reduce your own risks because payments are handled directly through Flutterwave’s secure servers.

How Does Payment Settlement Work?

When a customer pays on your store, the money first goes to your Flutterwave balance. From there, you can:

- Withdraw to Your Bank: Funds can be settled to your Nigerian bank account within 24–48 hours.

- Track Everything: View payment history, failed transactions, refunds, and payout reports on the Flutterwave dashboard.

If you run a high-volume store, you can also request instant settlement or schedule payouts.

What Are the Charges for Using Flutterwave?

The standard fees for Nigerian merchants are:

- 2.0% for local card transactions (includes a 1.4% transaction fee capped at ₦2,000 plus a 0.6% platform fee)

- 4.8% for international card transactions

- Value Added Tax (VAT is currently charged at 7.5% in Nigeria)

- No setup fees or monthly fees

Can I Customize the Flutterwave Checkout Page?

Yes, and this is great for branding.

You can:

- Add your store logo

- Set brand colors

- Customize the payment instruction text

- Include return URLs after payment success or failure

All of these options are available in the Flutterwave Dashboard under settings. A clean and familiar checkout experience boosts trust and increases completed payments.

What If I Run Into Issues?

Flutterwave has a solid support system. If you run into trouble:

- Visit the Flutterwave Help Center

- Open a support ticket directly from your dashboard

- Use live chat or email for quick help

Additionally, there are developer communities and YouTube tutorials that explain common issues and solutions in detail.

Running a successful online store in Nigeria requires more than just listing products. You need to make buying easy for your customers, especially when it comes to payments. That’s why WooCommerce and Flutterwave make such a powerful pair. You get the flexibility of an open-source e-commerce platform and the reliability of a payment system built for African businesses.

With just a few clicks, your store can be set up to receive Naira payments, bank transfers, and even international cards. You don’t need to be a tech expert, and the setup costs are low. What you gain is a trusted system that helps you sell more and get paid faster.

You’re not just integrating tools by choosing Flutterwave and WooCommerce, you’re giving your customers an experience they can count on. And that’s what keeps them coming back.