Kenya’s digital landscape is bustling, with businesses and customers embracing mobile money, online shopping, and cashless transactions more than ever. For any entrepreneur, finding the right payment gateway is like choosing the engine for a vehicle; reliable, secure, and easy to use, powering smoother and more efficient interactions with customers. Selecting the ideal payment solution isn’t just a technical choice; it’s a key step in building trust and expanding reach. Here’s a detailed look at some of the best payment gateways in Kenya, their features, advantages, and what makes each one stand out.

1. MPESA

MPESA, launched by Safaricom in 2007, transformed mobile payments in Kenya. It’s the country’s most popular payment method, with millions of users relying on it daily. Beyond peer-to-peer payments, MPESA is widely used in business transactions, making it an ideal choice for local businesses.

Features

- Wide Adoption: With a large user base, MPESA is highly recognizable and trusted across Kenya.

- Integration Options: MPESA integrates with online platforms, allowing e-commerce businesses to offer seamless payment.

- Low-Cost Transactions: The platform’s rates are affordable, especially for SMEs.

- Security: MPESA uses PIN authentication and offers secure encryption, making it a safe choice for customers and businesses.

Best For: MPESA is ideal for businesses targeting local customers who prefer mobile money.

2. Flutterwave

Flutterwave, a leading African fintech company, has gained traction across the continent for its versatility and innovative solutions. The platform supports multiple currencies and payment methods, making it popular for businesses aiming for both local and international reach.

Features

- Multi-Currency Support: Accept payments from over 150 countries and process various currencies.

- Multiple Payment Methods: Flutterwave allows credit card, debit card, MPESA, and even cryptocurrency payments.

- Customizable Checkout: Flutterwave provides a customizable checkout page for a seamless customer experience.

- Developer-Friendly: Flutterwave’s API is easy to integrate, making it a good option for developers and tech-savvy businesses.

Best For: Businesses with international customers or those requiring a highly customizable payment gateway.

3. PayPal

PayPal has long been a staple in global online payments. Although it’s not as integrated with local payment systems, it’s still widely used, especially for businesses targeting international customers.

Features

- Global Reach: PayPal is recognized worldwide, making it ideal for cross-border transactions.

- Integration with E-commerce Platforms: It integrates with major e-commerce platforms like Shopify, WooCommerce, and Magento.

- Instant Transfers: Transfers are instant and provide security features such as buyer protection.

Best For: Freelancers, international businesses, and entrepreneurs with global clientele.

4. Pesapal

Pesapal, based in Nairobi, offers flexible payment solutions tailored to East African businesses. It supports a variety of payment options, including credit cards, mobile payments, and online banking.

Features

- Local Bank Partnerships: Pesapal partners with local banks, increasing accessibility and simplifying payments.

- POS Solutions: Besides online payments, Pesapal provides Point of Sale (POS) systems for in-store payments.

- Multiple Payment Channels: Supports MPESA, Airtel Money, Visa, and Mastercard payments, covering most local methods.

- Advanced Analytics: Offers detailed transaction reports to help businesses monitor performance.

Best For: Brick-and-mortar stores, online retailers, and businesses wanting multi-channel payment solutions.

5. DPO (Direct Pay Online)

DPO, a leading payment solution in Africa, provides robust payment processing with a particular focus on the tourism and hospitality sectors. The platform’s versatility make it a popular choice for businesses.

Features

- Multiple Payment Options: DPO supports credit and debit cards, mobile payments, and bank transfers.

- Risk Management: DPO offers fraud protection and risk management tools, ideal for high-value transactions.

- Multi-Currency Processing: Businesses can accept payments in various currencies, making it suitable for international customers.

- Flexible Integrations: The platform integrates with a range of e-commerce platforms and booking engines.

Best For: Hospitality, tourism, and businesses handling high transaction volumes.

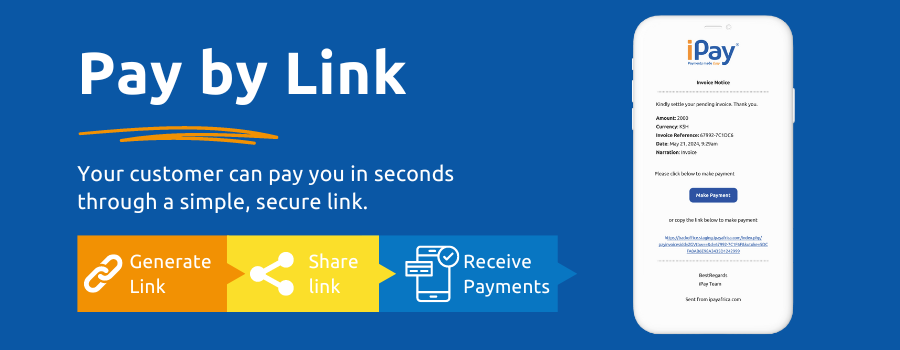

6. iPay

iPay is a Kenyan payment gateway known for its simplicity and ease of use. It’s a solid choice for SMEs and startups looking for a local-focused, straightforward solution.

Features

- Mobile Money Integration: iPay supports MPESA, Airtel Money, and Equitel, making it ideal for the Kenyan market.

- E-commerce Integration: Works with popular platforms like Shopify and WooCommerce.

- User-Friendly Dashboard: iPay’s dashboard makes managing transactions and tracking payments easy.

- Flexible Payment Options: Supports card payments and mobile money, covering both local and international needs.

Best For: SMEs and startups looking for an affordable and easy-to-manage payment gateway.

7. Equity Bank EazzyPay

EazzyPay by Equity Bank provides businesses with an efficient payment solution that connects directly to Equity Bank accounts. It’s popular for in-store payments and supports integration with online platforms as well.

Features

- Bank Integration: Directly linked to Equity Bank, allowing easy fund transfers and account management.

- Flexible Payment Options: Supports mobile money, card payments, and bank transfers.

- POS and E-commerce Compatibility: Works with both in-store POS and online platforms.

- Low Transaction Fees: Equity Bank offers competitive fees, especially for its account holders.

Best For: Businesses with an existing Equity Bank account or those needing both in-store and online payment solutions.

How to Choose the Right Payment Gateways for Your Business in Kenya

When choosing a payment gateway, consider your business’s specific needs. Here are a few points to help with your decision:

- Customer Base: If you primarily target local customers, MPESA or iPay may be the best fit. For international audiences, Flutterwave or PayPal might be more suitable.

- Transaction Fees: Compare fees for each platform, as they can impact your profit margins. Local gateways like MPESA or Equity Bank’s EazzyPay offer lower fees for Kenyan transactions.

- Integration Needs: If you use a specific e-commerce platform, make sure that the gateway integrates smoothly. Platforms like Flutterwave and DPO are known for easy e-commerce integration.

- Security Features: Look for gateways with security features to protect against fraud, especially if you’re handling high volumes or high-value transactions.

- Added Services: Consider if you might benefit from extra features like analytics or credit options.

The payment landscape in Kenya offers a rich selection of gateways, each with benefits suited to different business needs. From low transaction fees, easy integration, or multi-currency support, there’s a solution that fits just right. By weighing your options carefully, considering fees, security, and how well each suits with your customer base; you can select a payment gateway that doesn’t just make transactions smoother but also drives your business to grow and achieve its full potential.